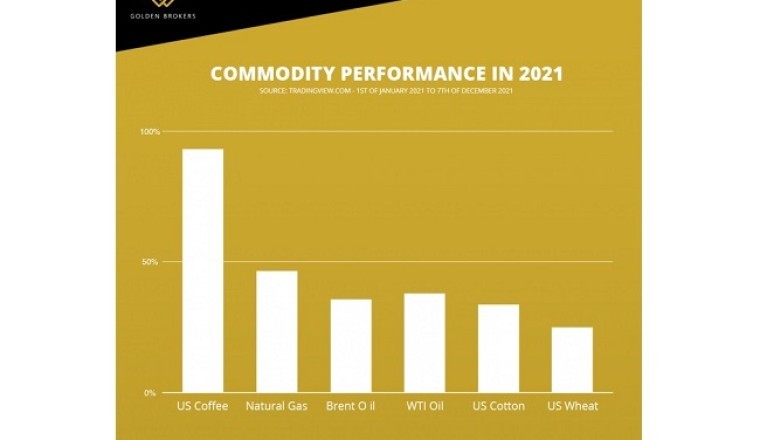

Dubai, United Arab Emirates (AETOSWire): The commodities market in 2021 has been rather turbulent. In General, commodities performance has been very strong throughout 2021 amid continued pressure on physical commodity markets, as reopening demand overwhelmed supply and drove down inventories. Golden Brokers has picked-up the best-performing commodities of 2021.

U.S. Coffee

Arabica coffee remains close to its highest levels since 2011 as frost and drought in Brazil, the world’s largest exporter, destroyed crops. Also, excessive rains in Colombia and shipping container shortages in Vietnam limited supplies.

The United States Department of Agriculture (USDA) estimated more global coffee production and consumption with increasing shipping & fertilizer costs and ongoing labor shortages.

Natural Gas

Prices doubled since last year. Demand is rebounding as consumers return to pre-pandemic activities, and producers have been reluctant to increase output quickly.

The future outlook depends on the coming winter. A colder winter means more heating demand, which can boost natural gas prices.

Oil (Brent & WTI)

Crude oil prices increased significantly in the third quarter, lifted by increased demand in Europe and China as lockdown measures were removed, less U.S. production due to Hurricane Ida and falling oil inventories.

However, the spread of Omicron increased investor concerns, plummeting oil 10% in the biggest one-day fall since April of 2021, but surging energy prices and a colder-than-expected winter could soar prices once more.

U.S. Cotton

Cotton saw an impressive 34.6% performance jump in 2021, witnessing its best quarter amid tight supply caused by a drought in the United States, and poor weather which hurt global crops.

Hiked prices pushed retailers to boost raw materials cost, therefore, the price of a cotton t-shirt rose about $2 on average. However, USA is reportedly aiming to expand cotton exports to Bangladesh, the world’s largest cotton importer behind Pakistan, which can settle cotton prices.

U.S. Wheat

Wheat rose to 9-year highs with worsening conditions of U.S. winter crops, raising concerns over global supply amid strong demand. Wheat has extended its rally after the USDA lowered its global supply forecasts for the 2021/2022 year.

Muhammad Zulbahri Mohd Rajdi

Chief analyst

Golden Brokers

Facebook Conversations

Disqus Conversations